If you're preparing to purchase a home, your next stop is a lender's office!

Before you begin shopping for homes, it's time to meet with a lender to get pre-approved for a home loan. Having a pre-approval letter can give you a leg up in this competitive market by showing sellers that you're a serious buyer with your finances in order. ✅

A lender will look at your finances, employment and credit to determine the loan you may qualify for.

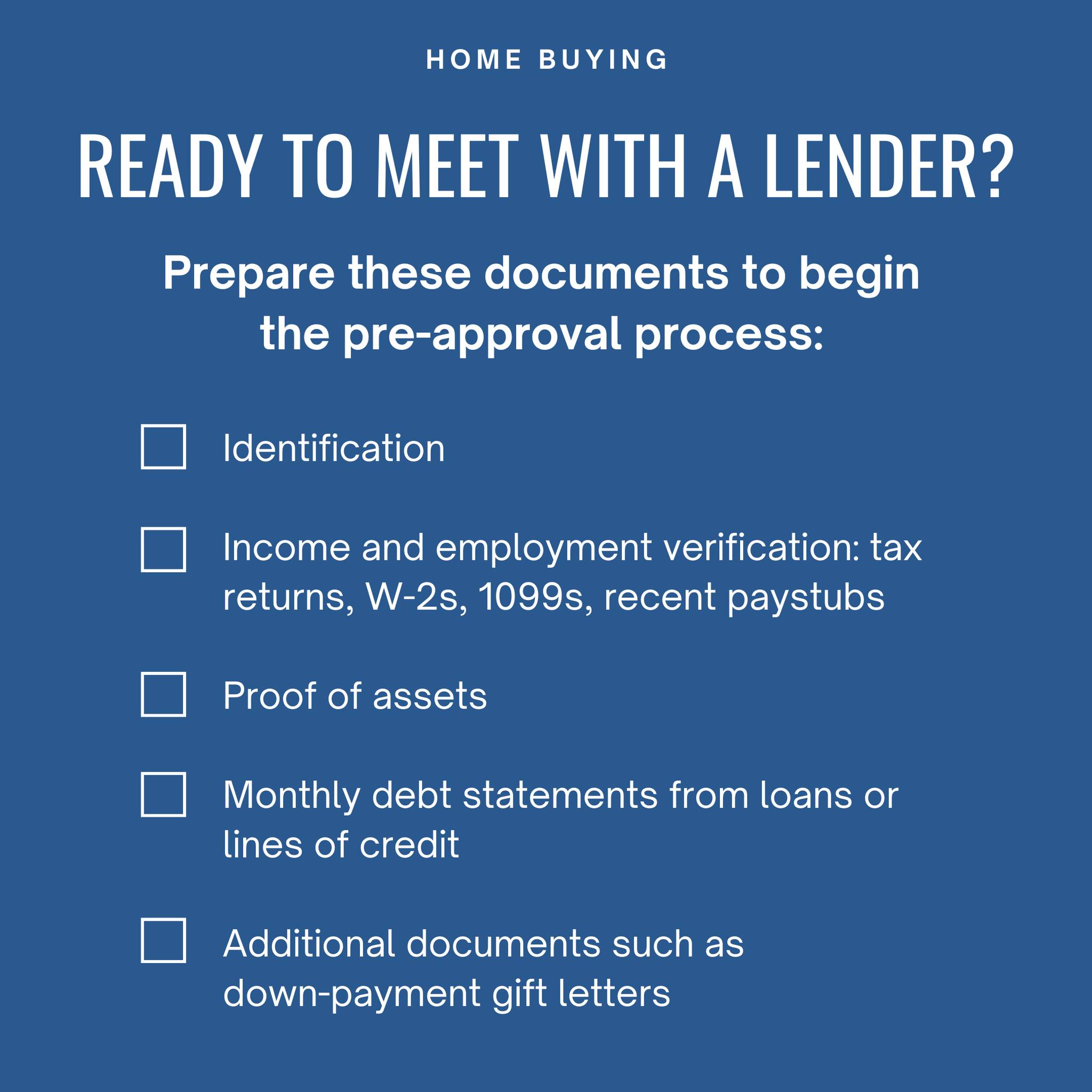

Start by preparing these 5 documents so you're ready to begin the pre-approval process! 👇

✔️ Identification

✔️ Income and employment verification: tax returns, W-2s, 1099s and recent paystubs

✔️ Proof of assets

✔️ Monthly debt statements from loans or lines of credit to determine debt-to-income ratio

✔️ Additional financial documents such as down-payment gift letters

If you have any questions about the pre-approval process, please reach out! 📲

The Cardwell Thaxton Group

📲(908) 456-1593

📧CardwellThaxton@gmail.com

#sellyourhousefast #sellyourhome #sellmyhouse #sellmyhousefastNJ #realtorswagger #realestateagent #realtorassociate #Moneyneversleeps #realestateappraiser #nareb #realestateinvestor #wholesaler #Veterans #investor #businesspassion #realtors #divorce #realestatelife #houses #property #househunting #homesearch #newjerseyrealestate #foreclosures #realestateconsultant #GardenState #NewJersey #MercerCounty